Introduction

If you’ve searched for kennedy funding ripoff report, chances are you’re feeling uneasy — maybe even alarmed. You might be considering a large commercial loan, facing tight deadlines, or dealing with a lender rejection, and suddenly you stumble across negative reviews, complaints, or “ripoff” headlines. That moment of doubt is powerful. When big money and real-world consequences are involved, no one wants to make a costly mistake.

This topic matters because Kennedy Funding operates in a niche where stress runs high: high-risk, time-sensitive commercial financing. Borrowers often arrive after exhausting traditional banks, and emotions are already running hot. Add the internet’s tendency to amplify dissatisfaction, and it’s easy for concern to spiral into fear.

In this article, we’re going to slow everything down and look at the situation clearly. You’ll learn what Kennedy Funding actually does, why ripoff reports exist, how to interpret them responsibly, and how to protect yourself as a borrower — whether you work with them or any other private lender. The goal isn’t hype or damage control. It’s clarity, context, and practical guidance so you can make decisions with confidence instead of anxiety.

Understanding the “Kennedy Funding Ripoff Report” Search Term

At its core, the phrase kennedy funding ripoff report doesn’t point to a single verified scandal or legal ruling. It’s a search behavior. People type it when they encounter complaints, reviews, or forum posts that raise red flags — especially on consumer grievance sites.

To understand this properly, it helps to think of ripoff reports like online complaint boxes. They are places where frustrated borrowers vent, sometimes fairly and sometimes emotionally. Unlike court records or regulatory actions, these platforms don’t require proof, context, or updates when situations are resolved.

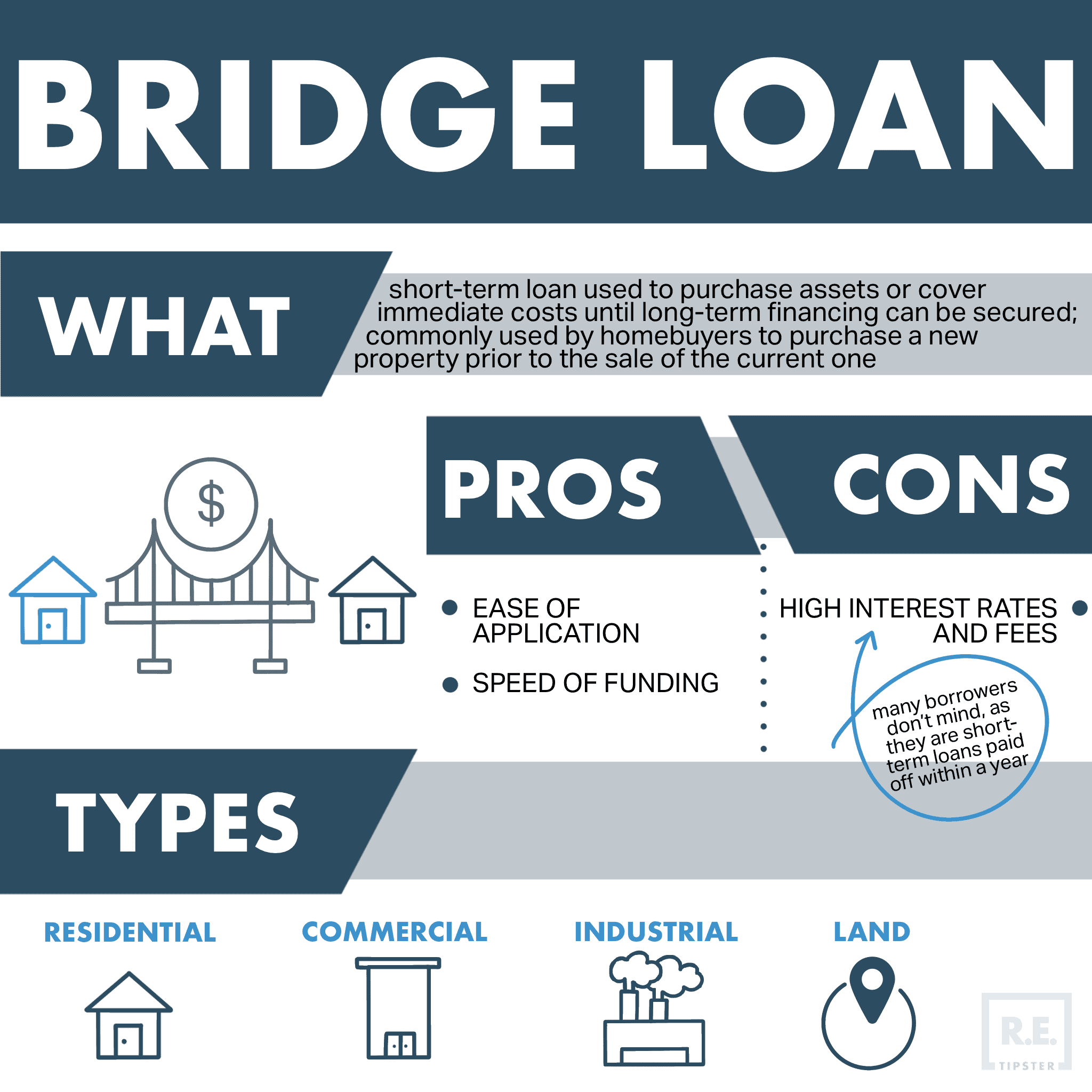

Kennedy Funding is a private, asset-based commercial lender. That means they do not operate like banks. They fund deals banks won’t touch — distressed properties, international assets, unconventional collateral, and borrowers with weak credit profiles. This model naturally produces friction. When a bank says “no,” it’s final and usually free. When a private lender says “maybe,” it often comes with due diligence fees, appraisals, and risk assessments.

Many ripoff-style complaints stem from this misunderstanding. Borrowers assume approval is guaranteed once a conversation starts. In reality, underwriting continues deep into the process. When deals fall apart, disappointment often turns into accusations, even if no fraud occurred.

Understanding this difference is critical before accepting any online claim at face value.

Why Kennedy Funding Gets Negative Reviews (And Why That’s Not the Full Story)

Negative reviews don’t exist in a vacuum. They usually emerge from patterns of expectation mismatch rather than outright deception. Kennedy Funding’s business model is built for speed and flexibility, but that flexibility comes at a price — literally and figuratively.

One common complaint involves upfront fees. Private lenders often charge for third-party reports, legal reviews, and valuations. Borrowers unfamiliar with hard money or bridge loans sometimes expect these fees to guarantee funding. When the loan doesn’t close, they feel cheated, even though the fees paid for real services already performed.

Another issue is loan-to-value expectations. Borrowers may believe their property is worth far more than conservative appraisals indicate. Kennedy Funding, like most asset-based lenders, bases decisions on liquidation value, not optimistic projections. When valuations come in lower, deals collapse — and frustration follows.

Timing is another flashpoint. Borrowers in distress often hear “fast funding” and interpret it as instant cash. While Kennedy Funding is faster than banks, complex international or distressed deals still take weeks. When deadlines are missed, emotions run high.

What’s often missing from ripoff reports is the other side of the ledger: borrowers who closed successfully, solved urgent problems, or saved projects that would have collapsed under traditional lending timelines. These borrowers are far less likely to post online.

Real-World Benefits and Use Cases of Kennedy Funding Loans

To understand why borrowers still work with Kennedy Funding despite the noise, you have to look at real use cases. Their services aren’t designed for average homebuyers or small personal loans. They serve a very specific market.

Kennedy Funding is often used by commercial developers who need bridge financing to stabilize a property before refinancing. For example, a partially leased shopping center might be unfinanceable by banks. A short-term loan allows renovations and tenant improvements that unlock long-term value.

International investors also rely on private lenders when U.S. banks hesitate due to jurisdictional complexity. Kennedy Funding’s willingness to evaluate overseas collateral opens doors others won’t.

Another common scenario involves time-sensitive debt resolution. Foreclosure deadlines, maturing balloon payments, or stalled construction projects require fast capital. In these cases, speed matters more than interest rates.

For borrowers who understand the costs and risks upfront, these loans can be lifelines. The key is alignment — knowing exactly what you’re getting into and why you’re choosing a private lender instead of a traditional one.

4

Step-by-Step: How to Evaluate Ripoff Claims Before You Believe Them

Before trusting or dismissing any kennedy funding ripoff report, follow a structured evaluation process. This approach applies to any lender and protects you from emotional decision-making.

Start by identifying the source. Is the complaint anonymous? Is it posted on a platform known for unverified submissions? Lack of accountability doesn’t invalidate a claim, but it does lower reliability.

Next, look for specifics. Credible complaints mention dates, amounts, contract terms, and clear timelines. Vague language like “they scammed me” without detail often signals frustration rather than fraud.

Then check for patterns. One complaint is noise. Ten complaints repeating the same factual issue may indicate a systemic problem. Be careful to distinguish between similar emotions and identical facts.

Finally, verify externally. Look for lawsuits, regulatory actions, or government enforcement. These carry far more weight than opinion-based platforms. Absence of such actions doesn’t prove perfection, but it provides important context.

This process transforms fear-based Googling into informed analysis — a skill every borrower should master.

Comparing Kennedy Funding to Other Private and Hard Money Lenders

Private lending isn’t monolithic. Kennedy Funding occupies one slice of a diverse market. Comparing them to other options helps clarify expectations.

Traditional hard money lenders often focus on smaller residential or mixed-use properties. Their loans are quicker but smaller and more localized. Kennedy Funding specializes in large, complex commercial deals, including international assets.

Crowdfunding platforms offer alternative capital but usually require stabilized properties and strong investor appeal. They are slower and less flexible when urgency is critical.

Private equity lenders bring deep pockets but demand equity stakes or operational control. For borrowers who want short-term debt without giving up ownership, this can be a deal-breaker.

Kennedy Funding’s niche is speed plus scale. That combination is rare and expensive. Whether it’s worth the cost depends entirely on the borrower’s situation, not on internet headlines.

4

Tools and Resources to Protect Yourself as a Borrower

Smart borrowers don’t rely on trust alone. They use tools and professionals to verify every step. Before engaging with any private lender, consider these safeguards.

Hire an independent real estate attorney to review term sheets and loan documents. This cost is small compared to potential losses and often clarifies misunderstandings before money changes hands.

Use third-party valuation services when possible. Comparing appraisals helps set realistic expectations and prevents shock later in the process.

Maintain written communication. Verbal assurances don’t hold weight in disputes. Emails and documented timelines protect both sides.

Finally, understand exit strategy planning. Private loans are short-term by design. Know exactly how you’ll refinance or repay before signing anything.

These tools don’t just reduce risk with Kennedy Funding — they make you a stronger borrower everywhere.

Common Mistakes Borrowers Make (And How to Avoid Them)

Most negative lending experiences stem from preventable errors. One major mistake is assuming approval equals funding. In private lending, approval is conditional until closing.

Another is underestimating total costs. Interest rates, fees, extensions, and legal expenses add up quickly. Borrowers who budget only for principal repayment often feel blindsided.

Lack of transparency is also common. Overstating property value or hiding issues almost always backfires during due diligence. Honesty speeds up deals; surprises kill them.

Finally, emotional decision-making leads borrowers into trouble. Panic loans taken without clear repayment plans often become expensive lessons.

Avoiding these mistakes won’t guarantee success, but it dramatically improves outcomes.

Conclusion

Searching for kennedy funding ripoff report is a natural reaction when high-stakes decisions collide with online negativity. But context matters. Kennedy Funding operates in a challenging corner of finance where risk, urgency, and complexity intersect. That environment produces friction — and friction produces complaints.

The real takeaway isn’t whether Kennedy Funding is “good” or “bad.” It’s whether their model fits your situation, expectations, and exit strategy. When borrowers understand the rules of private lending, ask the right questions, and protect themselves with professional guidance, outcomes improve dramatically.

If you’re evaluating lenders right now, use this knowledge as a filter. Read reviews, but don’t stop there. Dig deeper, verify facts, and choose based on alignment — not fear.

FAQs

Is Kennedy Funding a scam?

No verified evidence shows Kennedy Funding operating as a scam. Complaints largely stem from unmet expectations rather than proven fraud.

Why are there ripoff reports about Kennedy Funding?

Most relate to fees, failed deals, or misunderstandings about private lending processes.

Do upfront fees mean guaranteed approval?

No. Fees usually cover due diligence and do not guarantee funding.

Who should consider Kennedy Funding loans?

Borrowers with complex, time-sensitive commercial deals that banks won’t finance.

Are Kennedy Funding interest rates high?

Yes, compared to banks. That’s typical for short-term, high-risk private loans

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.