Introduction

Have you ever wondered why fuel prices don’t always fall immediately when global oil prices drop—or why farmers in many countries receive a guaranteed price for their crops regardless of market swings? That’s not market magic or coincidence. It’s the administered price mechanism at work.

In theory, prices are supposed to be set by supply and demand. In reality, governments often step in—quietly or very visibly—to influence, guide, or directly set prices for certain essential goods and services. The administered price mechanism exists at the intersection of economics and public policy, and it affects everyday life far more than most people realize.

This topic matters because administered prices shape inflation, household budgets, business profitability, and even political stability. From fuel and electricity to food grains and medicines, administered pricing can either cushion economies from shocks—or create long-term distortions if poorly designed.

In this in-depth guide, you’ll learn what the administered price mechanism actually is, how it works, where it’s used, why governments rely on it, and what happens when it goes wrong. We’ll break down complex theory into plain language, use real-world examples, and give you practical frameworks to understand and evaluate administered pricing systems—whether you’re a student, policymaker, analyst, or simply a curious reader.

What Is the Administered Price Mechanism?

At its core, the administered price mechanism refers to a system where prices are not left entirely to free market forces but are instead set, fixed, or influenced by an authority, usually the government or a regulatory body.

Think of it like a thermostat in your house. In a completely free market, prices fluctuate like the weather—sometimes hot, sometimes cold. An administered price mechanism steps in like a thermostat, preventing prices from rising too fast or falling too low, especially for essentials people rely on daily.

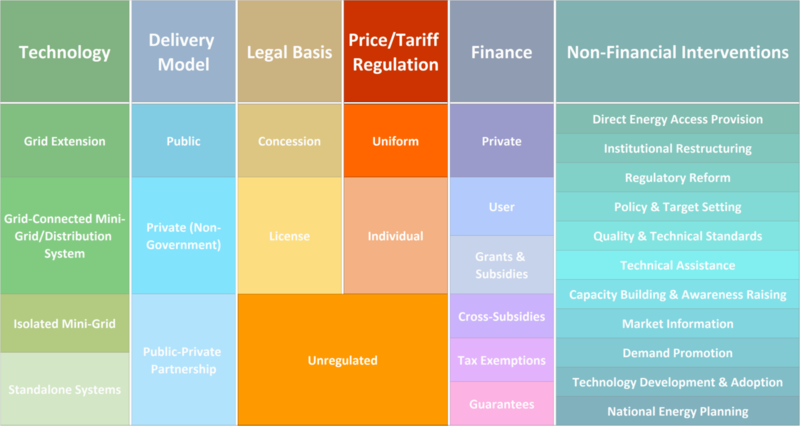

Administered prices can take several forms:

- Fixed prices (set at a specific level)

- Price bands or ceilings and floors

- Formula-based pricing linked to costs or benchmarks

- Periodic price revisions controlled by authorities

Unlike black-market price fixing or monopolistic manipulation, administered pricing is typically legal, transparent, and policy-driven. The goal is usually economic stability, social welfare, or protection of strategic sectors.

Common examples include:

- Government-set fuel prices

- Minimum support prices (MSP) for agricultural products

- Controlled electricity or water tariffs

- Regulated medicine prices

The mechanism doesn’t eliminate markets—it modifies them. Private players may still produce and distribute goods, but within pricing rules defined by policymakers.

Understanding this distinction is crucial. Administered pricing is not anti-market by default; it’s a corrective tool, meant to address market failures, protect vulnerable groups, or manage inflationary pressures.

Why Governments Use the Administered Price Mechanism

Governments don’t wake up one day and decide to control prices for fun. The administered price mechanism is typically deployed when markets alone fail to deliver socially acceptable outcomes.

One major reason is price volatility. Commodities like fuel, food, or energy can experience wild price swings due to global shocks, weather events, or speculation. Left unchecked, these fluctuations can destabilize economies and households.

Another reason is equity. Essential goods must remain affordable for low- and middle-income populations. If insulin, electricity, or staple foods were priced purely by profit motives, access could become dangerously unequal.

Key policy motivations include:

- Controlling inflation

- Ensuring affordability of essentials

- Supporting farmers or producers

- Protecting consumers from monopolies

- Maintaining political and social stability

There’s also a strategic dimension. Certain sectors—energy, agriculture, defense-related materials—are considered too important to be left entirely to market forces.

That said, administered pricing is always a balancing act. Set prices too low, and producers suffer. Set them too high, and consumers bear the cost. Good policy design matters more than ideology.

Benefits and Real-World Use Cases of Administered Pricing

When designed well, the administered price mechanism can be a powerful stabilizer. It acts like shock absorbers on a car—smoothing the ride during economic turbulence.

One clear benefit is predictability. Stable prices help households plan budgets and businesses forecast costs. For example, regulated electricity tariffs allow manufacturers to estimate operating expenses more accurately.

Another benefit is income security for producers, especially in agriculture. Minimum support prices protect farmers from market crashes during bumper harvests, ensuring they can cover costs and reinvest.

Real-world applications include:

- Fuel pricing formulas that smooth global oil shocks

- Guaranteed crop prices to stabilize rural incomes

- Medicine price caps to ensure healthcare access

- Public transport fare regulation for urban mobility

Administered pricing also helps governments signal policy priorities. By controlling prices in key sectors, states can direct investment, encourage domestic production, or discourage overconsumption.

However, these benefits only materialize when pricing decisions are transparent, data-driven, and periodically reviewed. Otherwise, the same mechanism can turn from stabilizer to bottleneck.

4

Step-by-Step: How the Administered Price Mechanism Works

Although it looks complex from the outside, the administered price mechanism usually follows a structured process.

Step one is cost assessment. Authorities analyze production costs, import prices, taxes, exchange rates, and distribution expenses. This ensures prices are grounded in economic reality rather than politics alone.

Step two involves policy objectives. Is the goal affordability, inflation control, producer support, or all three? The objective determines whether prices are capped, subsidized, or guaranteed.

Step three is price setting or formula design. Some governments fix prices outright, while others use formulas linked to global benchmarks, adjusted periodically.

Step four is implementation and monitoring. Regulators oversee compliance, compensate producers if prices are below cost, and track market responses.

Best practices include:

- Transparent pricing formulas

- Regular revisions instead of long freezes

- Independent regulatory oversight

- Clear communication with stakeholders

Common variations include partial deregulation, dual pricing systems, or targeted subsidies layered onto market prices. The smartest systems evolve over time rather than remaining rigid.

Tools, Models, and Policy Frameworks Used in Administered Pricing

Administered price mechanisms rely on more than political judgment—they’re built on analytical tools and institutional frameworks.

Cost-plus pricing models are common, especially in utilities. Prices are set by adding a reasonable margin to verified costs. This ensures sustainability but can reduce efficiency if poorly monitored.

Benchmark-linked pricing uses international reference prices, adjusted for local taxes and currency movements. Fuel pricing formulas often follow this approach.

Subsidy management systems are another tool. Instead of lowering prices for everyone, governments may compensate targeted groups directly, reducing fiscal burden.

Free vs. regulated approaches:

- Free pricing: efficient but volatile

- Fully administered: stable but distortion-prone

- Hybrid systems: balance efficiency and protection

Experts increasingly recommend hybrid models, where administered pricing gradually transitions toward market alignment while protecting vulnerable groups.

Common Mistakes in Administered Price Mechanisms (and How to Fix Them)

The biggest mistake is freezing prices for too long. When costs rise but prices don’t, shortages emerge, quality drops, and black markets thrive.

Another common error is politicizing price decisions. Short-term electoral gains often override long-term sustainability, leading to fiscal stress.

Frequent pitfalls include:

- Ignoring cost changes

- Lack of transparency

- Poor targeting of subsidies

- Weak regulatory enforcement

Fixes involve automatic adjustment formulas, independent regulators, and direct-benefit transfers instead of blanket price controls.

Administered pricing isn’t inherently flawed—bad design is.

4

Long-Term Economic Impact of Administered Pricing

Over time, the administered price mechanism shapes investment decisions, consumption patterns, and fiscal health.

Well-calibrated systems encourage stability and social trust. Poorly managed ones discourage private investment and strain public budgets.

The key is adaptability. Economies evolve, costs change, and policy tools must keep pace. Administered pricing works best when treated as a dynamic policy instrument, not a permanent crutch.

Conclusion

The administered price mechanism is neither hero nor villain—it’s a tool. In the hands of thoughtful policymakers, it can protect consumers, support producers, and stabilize economies. Used carelessly, it can distort markets and drain public resources.

Understanding how administered pricing works empowers you to see beyond headlines about fuel hikes or food subsidies. You begin to recognize the trade-offs, incentives, and policy choices shaping everyday prices.

If you’re analyzing policy, running a business, or simply trying to understand why prices behave the way they do, mastering this concept gives you a sharper economic lens. Keep learning, keep questioning—and don’t take prices at face value.

FAQs

What is an administered price mechanism in simple terms?

It’s when the government sets or controls prices instead of letting markets decide entirely.

Is administered pricing the same as price fixing?

No. Administered pricing is legal, policy-driven, and usually transparent.

Why is fuel often priced using administered mechanisms?

Because fuel affects inflation, transport costs, and overall economic stability.

Do administered prices cause shortages?

They can, if prices are set too low and not adjusted for costs.

Are administered prices used in developed economies?

Yes—especially in utilities, healthcare, and agriculture.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.