Introduction

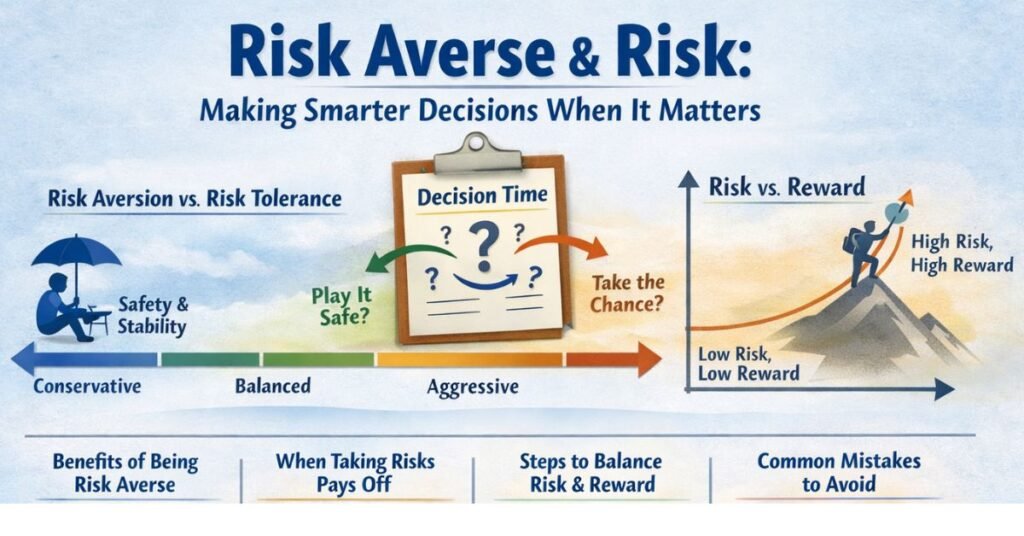

“Should I play it safe, or should I take the chance?”

That quiet question shows up everywhere—when you’re choosing a job, investing savings, launching a business, or even deciding whether to speak up in a meeting. At the heart of that moment sits the relationship between risk averse and risk. Within the first few minutes of any meaningful decision, we’re weighing uncertainty against reward, safety against upside, comfort against growth.

Being risk averse doesn’t mean being afraid. And embracing risk doesn’t mean being reckless. In the real world, the smartest decisions usually live somewhere in the middle—shaped by context, goals, experience, and consequences.

In this deep-dive guide, you’ll learn what risk aversion really means, how risk works in practice, and how seasoned professionals balance the two. We’ll move beyond textbook definitions and into real-life scenarios, practical frameworks, tools, and mistakes to avoid—so you can make decisions that feel confident, grounded, and aligned with what actually matters to you.

By the end, you’ll know how to:

- Understand your own risk profile without labels or judgment

- Apply risk-aware thinking to money, career, and life decisions

- Avoid common traps that cause people to either freeze or gamble blindly

- Build a repeatable, step-by-step process for smarter choices

Understanding Risk Averse and Risk (A Beginner-Friendly Breakdown)

Let’s start simple. Risk is uncertainty about outcomes. Whenever the future isn’t guaranteed—and it rarely is—risk is present. Risk aversion is a preference for certainty over uncertainty, even when the uncertain option may offer a higher reward.

Imagine two envelopes:

- Envelope A: Guaranteed $500

- Envelope B: 50% chance of $1,200, 50% chance of $0

A risk-averse person usually picks Envelope A. Not because Envelope B is “bad,” but because certainty feels more valuable than the possibility of disappointment. Someone more risk-tolerant might choose Envelope B because the potential upside excites them.

Here’s the important part: neither choice is wrong. Risk aversion is not a flaw; it’s a strategy. Risk-taking is not bravery by default; it’s a calculated posture toward uncertainty.

In real life, risk isn’t binary. It exists on a spectrum influenced by:

- Financial stability

- Time horizon

- Emotional resilience

- Experience and knowledge

- Consequences of failure

A young professional with minimal obligations may take career risks that a parent with a mortgage simply can’t. Context changes everything.

Understanding risk averse and risk isn’t about labeling yourself—it’s about recognizing how and why you respond to uncertainty in different situations.

The Psychology Behind Risk Aversion and Risk-Taking

Our brains didn’t evolve to maximize returns—they evolved to keep us alive. That’s why losses often hurt more than equivalent gains feel good. Psychologists call this loss aversion, and it explains why risk aversion is so common.

When faced with uncertainty, your brain asks:

- “What could go wrong?” before

- “What could go right?”

This bias shows up everywhere:

- Investors panic-sell during downturns

- Employees stay in jobs they dislike because the paycheck is safe

- Businesses avoid innovation to protect existing revenue

Risk-taking, on the other hand, is fueled by optimism, confidence, and sometimes overestimation of control. People who take risks often believe they can influence outcomes more than they realistically can.

Healthy decision-making happens when psychology is acknowledged—not ignored. Skilled decision-makers don’t suppress fear or chase adrenaline. They:

- Name the risk

- Quantify the downside

- Compare it to realistic upside

- Decide consciously rather than emotionally

Understanding your psychology around risk averse and risk behavior gives you leverage. You stop reacting—and start choosing.

Benefits and Use Cases: When Risk Aversion Works (and When Risk Pays Off)

Where Risk Aversion Shines

Risk aversion is powerful in situations where losses are irreversible or catastrophic. Examples include:

- Protecting emergency savings

- Ensuring stable income for dependents

- Compliance, safety, and legal decisions

- Health-related choices

In these cases, the downside outweighs any reasonable upside. Playing defense is smart.

Benefits of being risk averse include:

- Predictability and stability

- Lower stress and volatility

- Protection against worst-case scenarios

- Consistent long-term outcomes

Where Taking Risk Makes Sense

Risk becomes valuable when:

- Upside is asymmetric (small downside, large potential gain)

- Failure is survivable and informative

- You have time to recover

- The alternative is stagnation

Entrepreneurship, investing in skills, career pivots, and innovation all require risk. Avoiding it entirely often leads to missed opportunities and slow erosion of potential.

The best performers don’t choose between risk averse and risk behavior—they apply each deliberately based on the situation.

A Step-by-Step Framework to Balance Risk Averse and Risk Decisions

Step 1: Define the Decision Clearly

Vague choices create emotional responses. Be precise.

Instead of: “Should I change jobs?”

Ask: “Should I accept a role that pays 10% less but offers faster growth in a new industry?”

Clarity reduces fear.

Step 2: Identify the Downside (Worst-Case Reality)

Ask:

- What’s the absolute worst realistic outcome?

- Can I survive it financially, emotionally, professionally?

Write it down. Most fears shrink once named.

Step 3: Identify the Upside (Not the Fantasy)

Be honest. Not “I’ll be wildly successful,” but:

- New skills

- Better network

- Increased optionality

Measured upside leads to rational risk-taking.

Step 4: Assess Probability (Roughly Is Fine)

You don’t need perfect math. Ask:

- Is success more likely than failure?

- What would I tell a friend in this situation?

Step 5: Decide Your Risk Budget

Think of risk like money. You have a limited budget.

If you’re taking big risk in one area, balance it with safety elsewhere.

This is how professionals manage risk averse and risk choices without burning out or blowing up.

Tools, Comparisons, and Practical Recommendations

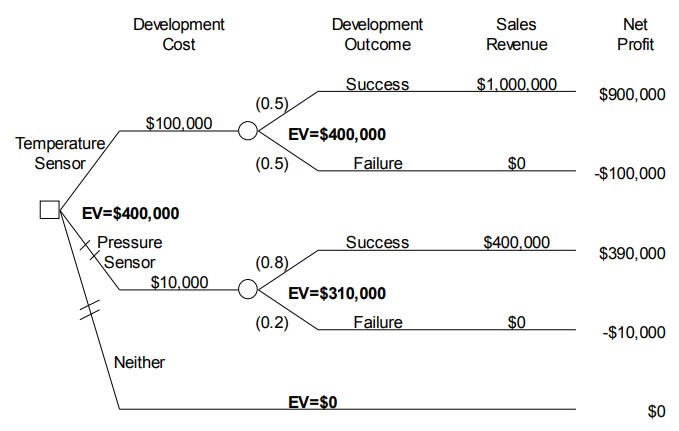

Mental Models (Free, Powerful, Underused)

- Expected Value Thinking: Multiply outcomes by probabilities

- Inversion: Ask how a decision could fail, then avoid those paths

- Barbell Strategy: Combine extreme safety with selective high-risk bets

Financial Tools

Conservative (Risk Averse):

- High-yield savings accounts

- Government bonds

- Index funds with long horizons

Moderate to High Risk:

- Equity-heavy portfolios

- Startups and private investments

- Skill-based investments (education, training)

Free vs Paid Decision Tools

Free:

- Spreadsheets

- Journaling frameworks

- Scenario mapping

Paid:

- Financial advisors

- Risk profiling software

- Portfolio simulators

Paid tools add value when stakes are high or complexity increases—but clarity always beats complexity.

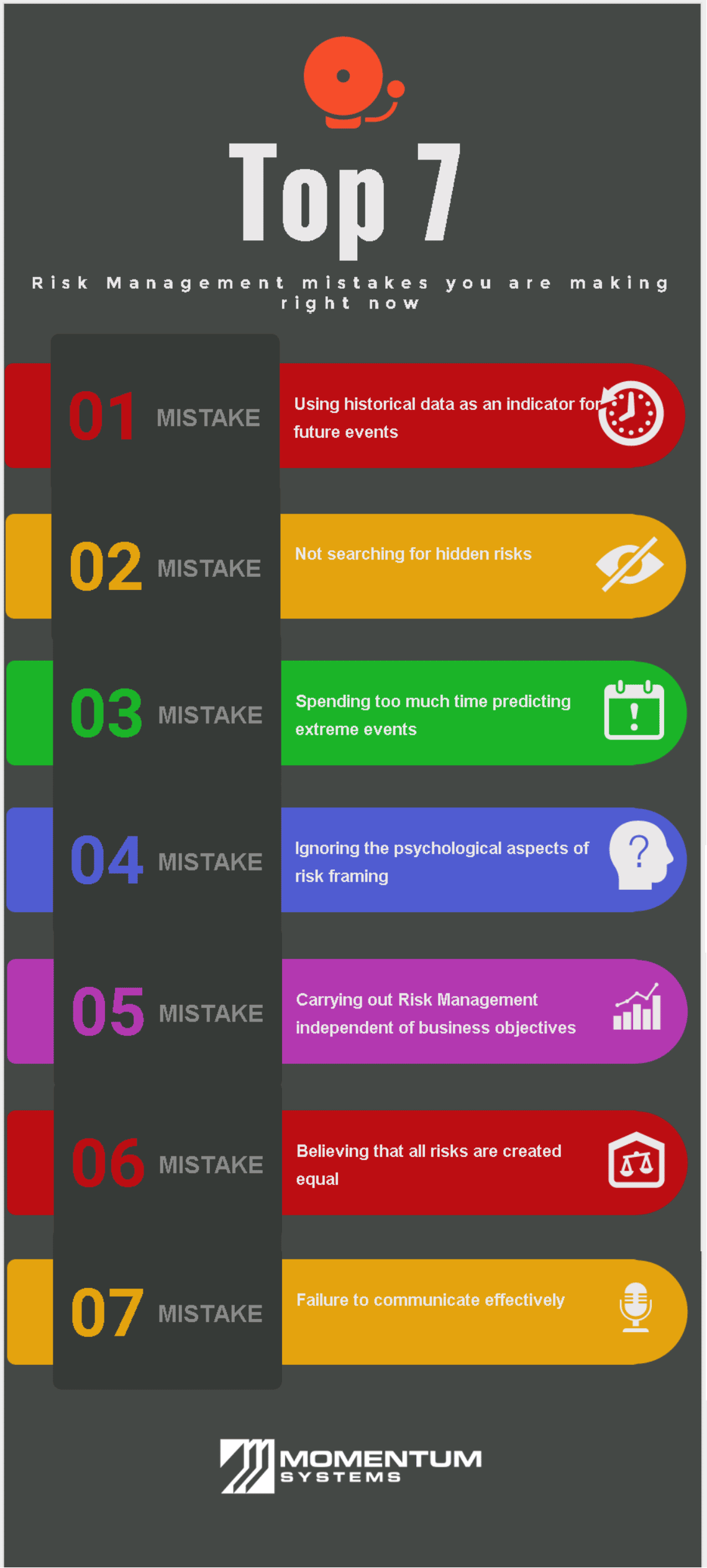

Common Mistakes with Risk Averse and Risk Thinking (and How to Fix Them)

Mistake 1: Confusing Comfort with Safety

Comfort feels safe—but isn’t always. Staying in a declining role or outdated skill set can be riskier than change.

Fix: Compare long-term risk, not short-term discomfort.

Mistake 2: All-or-Nothing Thinking

Some people avoid all risk. Others chase it everywhere.

Fix: Segment decisions. Be conservative where it matters, bold where it pays.

Mistake 3: Ignoring Opportunity Cost

Not acting is still a decision—with consequences.

Fix: Ask, “What do I lose by doing nothing for the next 3–5 years?”

Mistake 4: Letting Emotions Decide

Fear and excitement both distort judgment.

Fix: Delay decisions by 24–48 hours and revisit with structure.

Avoiding these mistakes alone puts you ahead of most people navigating risk averse and risk choices.

Conclusion: The Real Power Is Choosing, Not Avoiding

Risk isn’t the enemy. Blind risk is.

Risk aversion isn’t weakness. Unexamined fear is.

When you understand how risk averse and risk dynamics work, you stop outsourcing decisions to emotion or habit. You begin choosing with intention—protecting what matters most while still creating room for growth.

The goal isn’t to be fearless. It’s to be thoughtful, prepared, and honest about trade-offs.

If this guide helped you think differently about risk, share it, bookmark it, or apply the framework to a decision you’ve been delaying. The clarity alone is often worth more than the outcome.

FAQs

What does risk averse mean in simple terms?

It means preferring certainty over uncertainty, even if the uncertain option could offer higher rewards.

Is being risk averse bad?

No. It’s often smart, especially when losses would be severe or irreversible.

Can someone be both risk averse and risk-taking?

Yes. Most people are conservative in some areas and bold in others.

How do I know my risk tolerance?

Look at past decisions, emotional reactions to loss, and recovery time after setbacks.

Does risk always mean money?

No. Risk applies to career, relationships, reputation, health, and time.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.