Introduction: Why Risk Averting Matters More Than Ever

If you’ve ever hesitated before making a big decision—switching careers, investing savings, launching a product—you’ve already practiced risk averting, whether you called it that or not. Risk averting is the instinct (and skill) of protecting yourself from unnecessary downside while still moving forward. It’s the difference between paralysis and reckless leaps.

Today’s world amplifies uncertainty. Markets swing fast. Technologies disrupt overnight. One bad call can feel expensive—financially, emotionally, or reputationally. That’s why learning how to avert risk intelligently matters. Done right, risk averting doesn’t mean playing small. It means playing smart.

In this guide, you’ll learn what risk averting actually means, how it differs from fear-based avoidance, and how seasoned professionals use it to make confident decisions. We’ll cover benefits, real-world use cases, a step-by-step framework, tools and comparisons, common mistakes (and fixes), and FAQs. By the end, you’ll have a clear, practical approach to reducing downside without sacrificing opportunity.

What Is Risk Averting? A Clear, Beginner-Friendly Explanation

Risk averting is the practice of anticipating potential losses and taking deliberate steps to reduce their likelihood or impact—before committing fully. Think of it like wearing a seatbelt. You still drive. You still go places. You just protect yourself in case something goes wrong.

Many people confuse risk averting with being risk-averse. They’re related but not identical. Risk-averse behavior often avoids uncertainty altogether. Risk averting behavior acknowledges uncertainty and manages it. The former can stall progress; the latter enables progress with guardrails.

A helpful analogy: imagine crossing a river. Risk avoidance means refusing to cross. Risk averting means checking the depth, choosing a stable crossing, maybe using a rope—and then crossing anyway.

In practice, risk averting shows up everywhere:

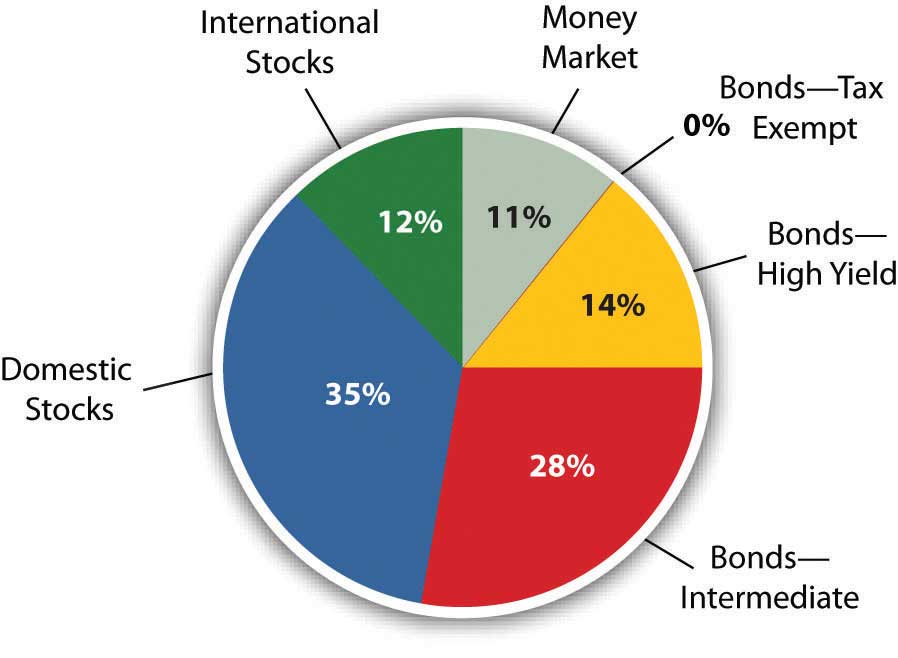

- An investor diversifies instead of betting everything on one stock.

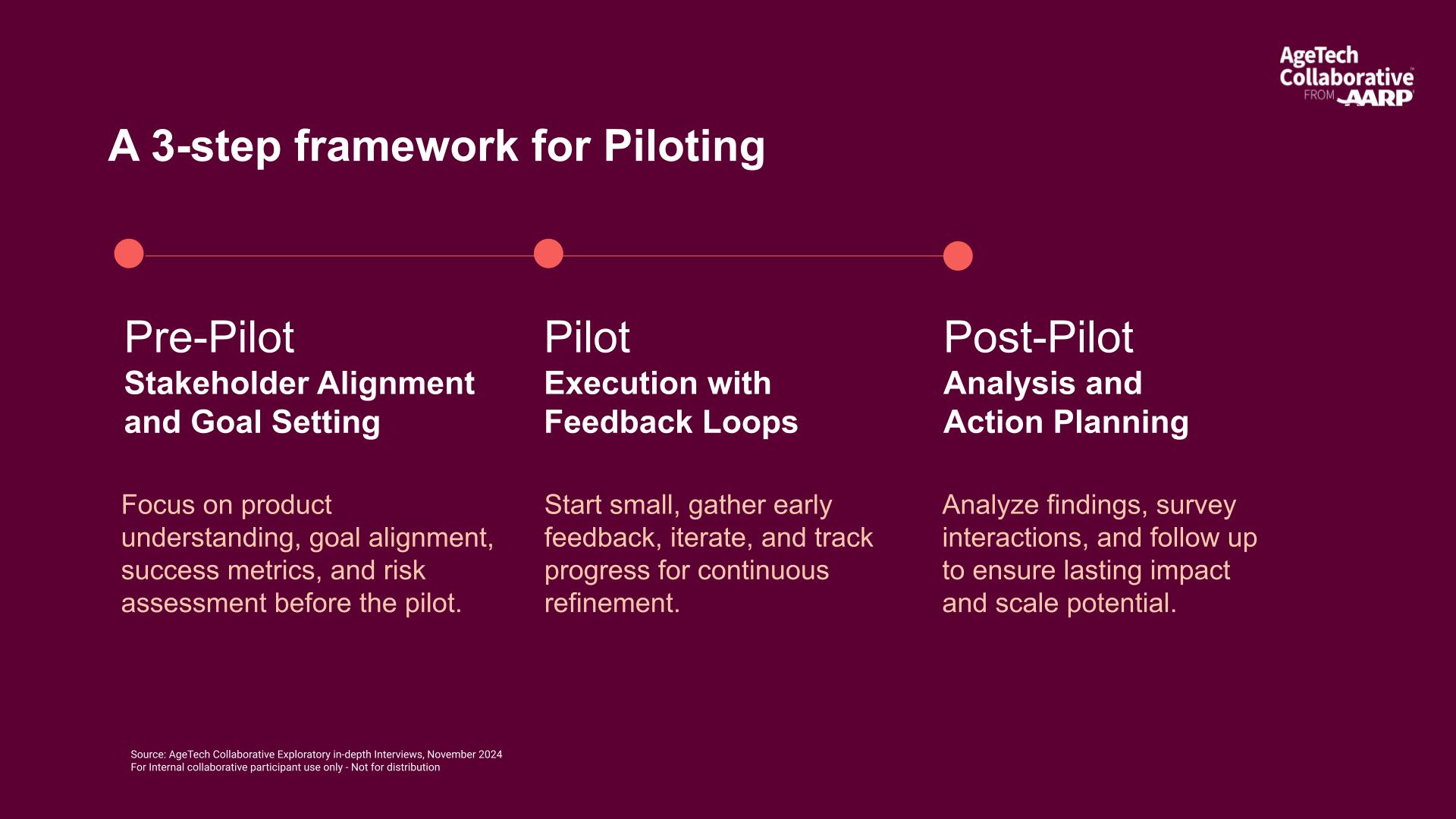

- A founder tests a product with a small pilot before a full launch.

- A professional negotiates a trial period before changing jobs.

At its core, risk averting blends foresight, preparation, and proportional action. You don’t eliminate risk—you shape it into something survivable and manageable.

Benefits & Use Cases: Where Risk Averting Shines

4

Risk averting delivers value because it protects your downside while preserving upside. That balance is powerful in real life.

Key Benefits

- Financial protection: Limits catastrophic loss through diversification, hedging, or staged investments.

- Better decisions under pressure: Structured risk checks reduce emotional choices.

- Sustainable growth: You can take repeated shots without blowing up after one miss.

- Confidence and clarity: Knowing your worst-case scenario is survivable makes action easier.

Real-World Use Cases

- Investing: Long-term investors avert risk by diversifying, setting stop-loss rules, and aligning investments with time horizons.

- Business: Teams avert risk with MVPs, A/B tests, and contingency plans before scaling.

- Career moves: Professionals avert risk by upskilling, networking quietly, and lining up offers before resigning.

- Personal finance: Families avert risk by maintaining emergency funds and adequate insurance.

- Health and lifestyle: From training plans to preventive care, risk averting reduces injury and burnout.

Risk averting works best for people who want progress without drama—those who value steady compounding over flashy wins. It’s especially useful when stakes are high and reversibility is low.

Step-by-Step Guide: How to Practice Risk Averting the Right Way

4

This framework is used by investors, executives, and planners because it’s simple and repeatable.

Step 1: Define the Decision and Stakes

Write down what you’re deciding and what’s at risk—money, time, reputation, relationships. Vague fears shrink when named.

Step 2: Identify the Real Risks

List plausible downsides, not wild fantasies. Ask:

- What could go wrong?

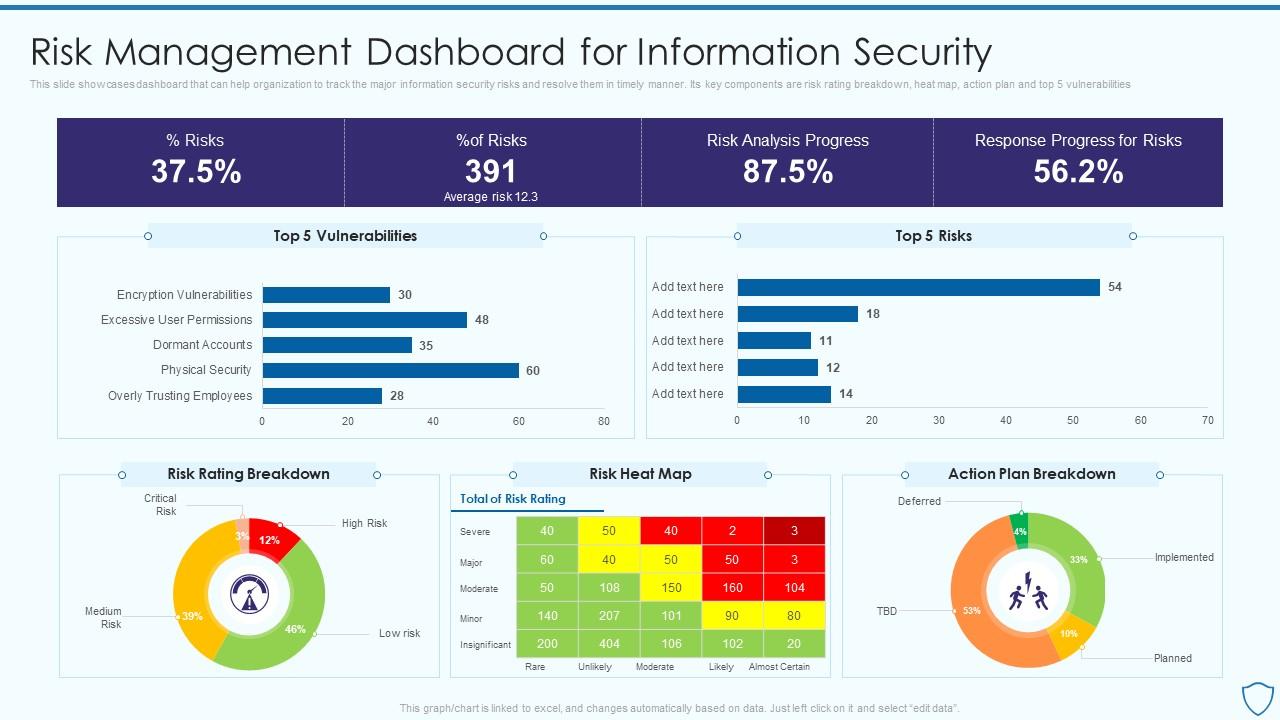

- How likely is it?

- How severe would the impact be?

Step 3: Map Mitigation Options

For each risk, list actions that reduce probability or impact:

- Start smaller

- Add a buffer (cash, time, support)

- Create exit options

- Transfer risk (insurance, contracts)

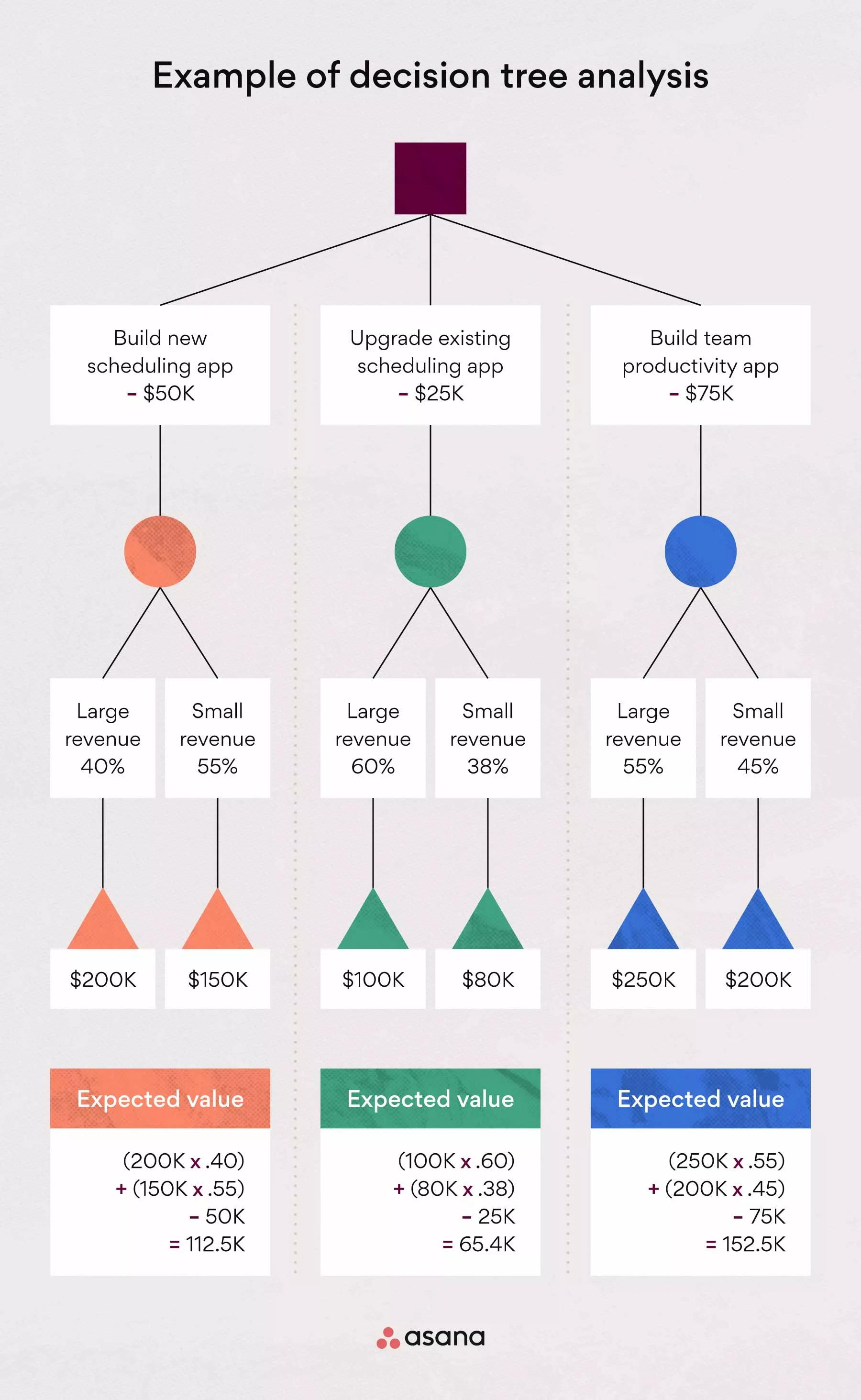

Step 4: Run Best–Base–Worst Scenarios

Sketch three outcomes. If the worst case is survivable—and the upside meaningful—you’re likely within a smart risk-averse zone.

Step 5: Decide and Monitor

Make the call, then set review points. Risk averting is dynamic; adjust as new information arrives.

Best practices:

- Prefer reversible decisions when possible.

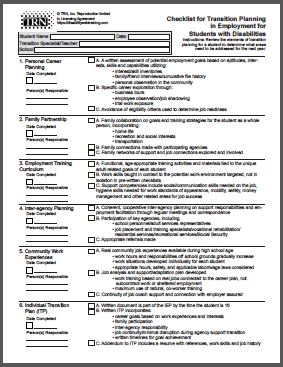

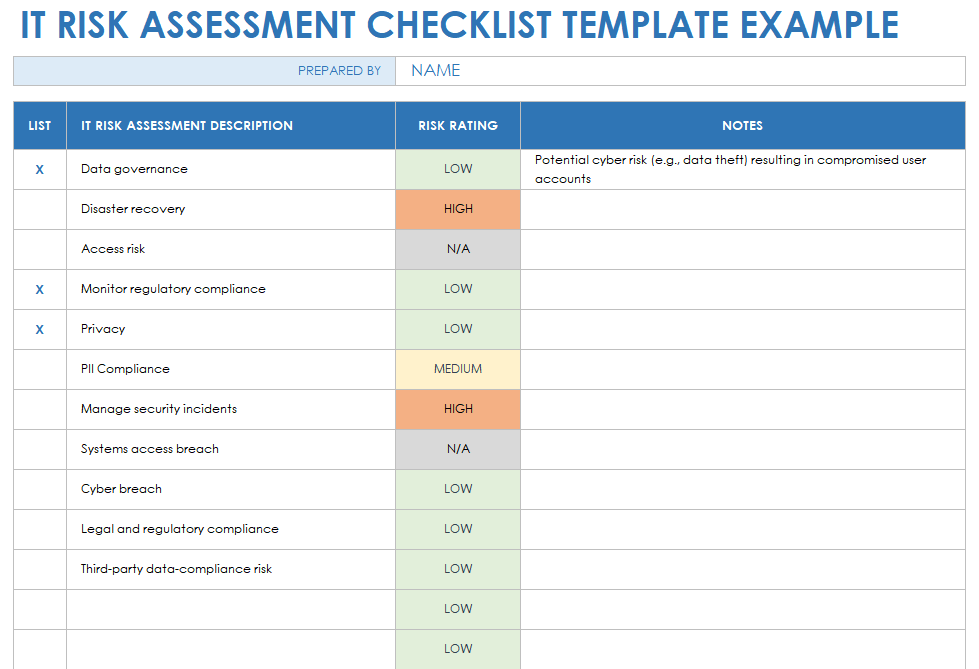

- Use checklists to avoid blind spots.

- Separate facts from feelings.

Tools, Comparisons & Recommendations

4

The right tools make risk averting practical rather than theoretical.

Free Tools

- Spreadsheets: Simple risk matrices, scenario models, and cash-flow buffers.

- Checklists: Pre-mortems and decision logs.

- Basic budgeting apps: Track burn rates and emergency funds.

Pros: Accessible, flexible, zero cost

Cons: Manual updates, error-prone at scale

Paid Tools

- Portfolio trackers and robo-advisors: Automated diversification and rebalancing.

- Project management software with risk logs: Visibility across teams.

- Financial planning platforms: Scenario modeling and stress tests.

Pros: Automation, analytics, alerts

Cons: Subscription costs, learning curve

Expert Recommendations

- Start simple. Complexity should earn its keep.

- Pay for tools when stakes or scale justify it.

- Review tools quarterly to ensure they still fit your goals.

The goal isn’t tool hoarding—it’s decision clarity.

Common Mistakes & Fixes in Risk Averting

Even smart people stumble here. These are the most frequent errors—and how to fix them.

Mistake 1: Over-Avoiding Risk

Symptom: Endless research, no action.

Fix: Set decision deadlines and define acceptable loss upfront.

Mistake 2: Ignoring Opportunity Cost

Symptom: Feeling “safe” but stagnant.

Fix: Measure the cost of inaction alongside potential losses.

Mistake 3: False Diversification

Symptom: Many bets that all fail together.

Fix: Diversify across true drivers (time, geography, asset type).

Mistake 4: Static Plans

Symptom: Plans that don’t change as reality does.

Fix: Schedule reviews and adapt quickly.

Mistake 5: Emotional Overrides

Symptom: Panic selling or doubling down.

Fix: Pre-commit rules before emotions run high.

Risk averting works when it’s disciplined, not reactive.

Conclusion: Risk Averting Is About Control, Not Fear

Risk averting isn’t about hiding from uncertainty—it’s about owning it. When you anticipate downside, build buffers, and choose reversible paths, you earn the right to move forward with confidence. The most successful people aren’t fearless; they’re prepared.

Use the framework. Start small. Review often. Over time, risk averting becomes a habit—one that compounds into better outcomes and fewer sleepless nights. If you found this helpful, explore your next decision through this lens and see how much calmer—and clearer—it feels.

FAQs

What does risk averting mean in simple terms?

It means taking smart steps to reduce potential losses before making a decision.

Is risk averting the same as being risk-averse?

No. Risk averting manages risk; risk aversion often avoids it entirely.

Can risk averting limit growth?

Only if overdone. Balanced risk averting enables sustainable growth.

How do investors practice risk averting?

Through diversification, time horizons, position sizing, and rules-based decisions.

Is risk averting useful outside finance?

Absolutely—careers, health, relationships, and business all benefit.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.