If you’ve searched for applied medical technology stock, chances are you’re not just casually browsing. You’re likely trying to answer a very specific question: Is there a real investment opportunity here—or am I chasing a name that doesn’t trade publicly?

That confusion is more common than most people admit, even among experienced investors. I’ve seen seasoned market participants assume a ticker exists simply because a company’s products are everywhere in hospitals, clinics, and long-term care facilities.

This article exists to clear that fog completely.

We’re going to unpack what “applied medical technology stock” actually refers to, why people search for it, whether you can invest directly, and—most importantly—how to position yourself strategically if your goal is exposure to high-quality medical technology businesses.

This guide is written for:

- Long-term investors exploring healthcare and medtech

- Professionals who keep hearing the name and want clarity

- Retail investors trying to avoid costly assumptions

- Anyone who wants real-world, experience-driven insight—not hype

By the end, you’ll understand not only the stock question, but the bigger investment picture behind applied medical technology as a sector.

What “Applied Medical Technology Stock” Actually Means (And Why It’s So Misunderstood)

The phrase applied medical technology stock sounds straightforward, but it hides two very different interpretations.

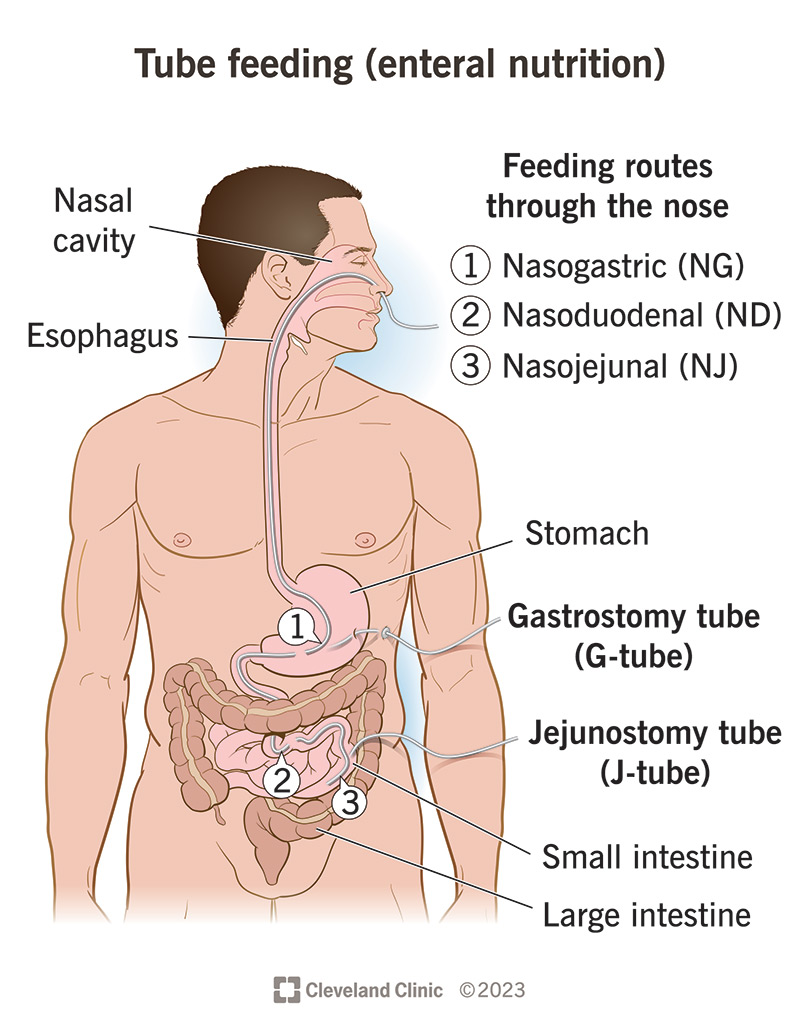

The first interpretation is literal: investors are searching for shares of Applied Medical Technology, a U.S.-based medical device company known for feeding tubes, drainage products, and long-term care solutions. The second interpretation is broader: people are looking for stocks in applied medical technology as an industry—companies that turn medical science into practical, revenue-generating tools.

Here’s the critical truth many articles gloss over:

Applied Medical Technology (the company) is privately held.

There is no publicly traded applied medical technology stock with a ticker symbol you can buy today.

That single fact explains:

- Why investors keep searching

- Why financial platforms show “no data”

- Why forums are full of contradictory answers

But this doesn’t make the search meaningless. In fact, it often signals early-stage investment intent—people trying to get ahead of trends before they become obvious.

Understanding this distinction is the foundation for every smart decision that follows.

Understanding Applied Medical Technology as a Business Model (Beginner → Expert)

Think of applied medical technology like the bridge between the lab and the hospital bedside.

Pure medical research answers questions. Applied medical technology solves problems.

Instead of asking, “Can we do this scientifically?” applied medtech asks, “Can this improve patient outcomes, reduce costs, and work at scale in the real world?”

At a beginner level, applied medical technology includes:

- Medical devices used daily by clinicians

- Patient care tools that reduce complications

- Equipment designed for safety, efficiency, and repeatability

At an advanced level, it becomes:

- Regulatory-driven innovation

- Manufacturing precision under strict compliance

- Long-term contracts with healthcare systems

- Incremental improvements that generate consistent revenue

Companies in this space don’t chase viral headlines. They win through:

- Trust

- Reliability

- Clinical adoption

- Operational excellence

This is why investors are drawn to the idea of applied medical technology stock. It represents durable demand, not speculative hype.

Why Investors Keep Searching for Applied Medical Technology Stock

When a company doesn’t trade publicly but still generates buzz, that’s not accidental.

Investors tend to search for applied medical technology stock because:

- The company’s products are widely used

- Healthcare demand is non-cyclical

- Medical devices have strong switching costs

- Revenue tends to be stable rather than explosive

I’ve personally seen investors assume, “If hospitals rely on it, surely it’s public.” That’s a reasonable assumption—but not always a correct one.

Private medical device companies often stay private because:

- They generate steady cash flow without needing public capital

- Regulatory pressure discourages short-term market thinking

- Founders prefer operational control

- Long-term contracts reduce funding needs

Ironically, these same qualities make them attractive to public-market investors—which fuels continued search interest.

Real-World Benefits and Use Cases of Applied Medical Technology

Applied medical technology isn’t abstract. It shows up in real patient outcomes every day.

Hospitals benefit because:

- Devices are standardized and reliable

- Staff training is straightforward

- Complication rates are reduced

- Procurement costs are predictable

Clinicians benefit because:

- Tools are designed for practical use, not theory

- Time spent troubleshooting equipment decreases

- Patient safety improves

Healthcare systems benefit because:

- Long-term care costs drop

- Readmission rates improve

- Compliance risks are minimized

From an investment lens, this translates to:

- Recurring demand

- Long product life cycles

- High barriers to entry

- Slow but resilient growth

This is the opposite of flashy biotech speculation. It’s closer to infrastructure investing—quiet, durable, and essential.

How to Gain Exposure Without an Actual Applied Medical Technology Stock

This is where experienced investors separate themselves from frustrated searchers.

If a company is private, you don’t give up—you zoom out.

Here’s a step-by-step, practical approach.

First, accept the private status. Chasing a nonexistent ticker wastes time and leads to poor decisions.

Second, identify public peers operating in similar applied medtech niches:

- Medical device manufacturers

- Long-term care technology providers

- Patient nutrition and access solution companies

Third, evaluate exposure through:

- Healthcare ETFs

- Medical device-focused funds

- Conglomerates with applied medtech divisions

Fourth, assess fundamentals that mirror private-company strengths:

- Consistent revenue

- Regulatory compliance track record

- Hospital and provider contracts

- Low product obsolescence risk

Finally, monitor private-company signals:

- Expansion announcements

- Leadership changes

- Acquisitions by public firms

This approach doesn’t just replace applied medical technology stock—it often improves your risk-adjusted outcome.

Tools, Comparisons, and Expert Investment Recommendations

Investors often ask whether to use individual stocks, ETFs, or thematic funds.

In practice:

- Beginners benefit from diversified healthcare ETFs

- Intermediate investors target medical device subsectors

- Advanced investors combine public exposure with private market awareness

ETFs offer:

- Instant diversification

- Lower company-specific risk

- Easier liquidity

Individual stocks offer:

- Higher upside

- More research responsibility

- Greater volatility

Private-market platforms occasionally offer:

- Pre-IPO access

- Higher risk thresholds

- Long lockup periods

My professional recommendation? Start public, learn the space deeply, and only then consider private exposure if your capital and patience allow it.

Common Mistakes Investors Make (And How to Avoid Them)

The biggest mistake is assuming a ticker exists.

Other common errors include:

- Confusing applied medical technology with biotech startups

- Overestimating growth speed

- Ignoring regulatory timelines

- Chasing headlines instead of contracts

The fix is straightforward but disciplined:

- Verify company structure before investing

- Read FDA and compliance histories

- Focus on adoption, not innovation alone

- Prioritize durability over excitement

What most people miss is that boring healthcare businesses often outperform exciting ones over time.

The Bigger Picture: Why Applied Medical Technology Still Matters

Even without a direct applied medical technology stock, the concept matters deeply.

Healthcare systems are under pressure:

- Aging populations

- Staffing shortages

- Cost containment demands

Applied medical technology addresses all three.

That’s why private companies thrive quietly—and why public companies acquire them at premiums.

If you understand this dynamic, you’re already ahead of most investors typing the keyword into Google.

Conclusion: Turning Search Confusion Into Investment Clarity

The search for applied medical technology stock isn’t wrong—it’s incomplete.

There is no publicly traded stock under that exact name. But there is a powerful, investable theme hiding behind the query.

If you:

- Understand the difference between private companies and public exposure

- Focus on applied solutions over speculative science

- Invest with patience and realism

You position yourself for smarter, more resilient healthcare investing.

The goal isn’t to find a ticker.

The goal is to understand where value quietly compounds.

FAQs

Is Applied Medical Technology a publicly traded company?

No. Applied Medical Technology is privately held and does not have a public stock ticker.

Why do people search for applied medical technology stock so often?

Because the company’s products are widely used, leading many to assume it’s publicly traded.

Can I invest in Applied Medical Technology before an IPO?

Only through private markets, which typically require high capital and accreditation.

Are there similar public companies to Applied Medical Technology?

Yes, several public medical device companies operate in overlapping applied medtech niches.

Is applied medical technology a good investment theme?

Yes. The sector benefits from durable demand, regulatory protection, and healthcare necessity.

Adrian Cole is a technology researcher and AI content specialist with more than seven years of experience studying automation, machine learning models, and digital innovation. He has worked with multiple tech startups as a consultant, helping them adopt smarter tools and build data-driven systems. Adrian writes simple, clear, and practical explanations of complex tech topics so readers can easily understand the future of AI.